Ensuring compliance with relevant regulations and industry standards is a critical aspect of successful accounts payable outsourcing. AP providers are fully equipped with the skills, tools, and technology to independent and dependent variables not only manage existing accounts payable functions, but integrate new capabilities, for a more streamlined environment. Managing accounts payable (AP) stands out as a critical yet often complex function.

Streamlining Invoice Receipt and Processing

Regular reporting and meetings to discuss performance and improvements should be part of their service. Businesses should establish clear communication channels and expectations with their outsourcing provider from the outset to address communication challenges. This may include regular progress updates, meetings, https://www.personal-accounting.org/how-to-get-a-bank-statement/ and clearly defined points of contact to ensure that any issues or concerns are promptly addressed and resolved. This increased visibility can enable businesses to monitor their cash flow better, identify potential issues or opportunities, and make more informed decisions related to their financial operations.

The Benefits of Outsourcing Accounting Services to QX:

Usually, such third parties use internal servers and cloud storage to store sensitive data. While it serves as centralized access for both parties involved, the data is also prone to potential security breaches and hacks. According to research, the global accounts payable automation market is set to reach USD 1,567 million by 2025. Although live customer support is ideal, it may not always be in the price range.

Invoice Processing

- Accounts payable outsourcing is a handy solution for companies to make their AP processes efficient & cost-effective.

- Before making a decision, conduct exhaustive research and assess multiple providers.

- Companies offering accounts payable services focus only on your AP processes; completing the work faster and more accurately.

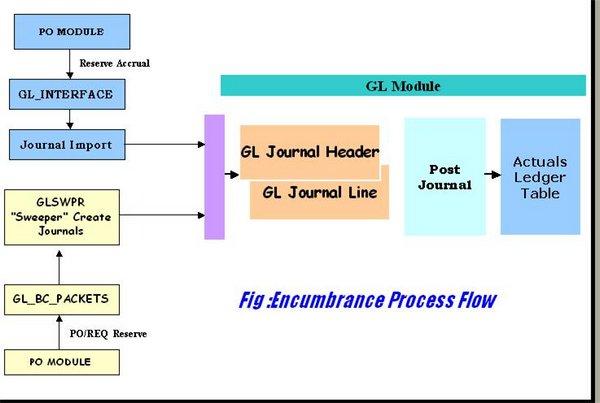

Outsourced firms for accounts payable have automated tracking features that allow partner businesses to monitor every step of the accounting process as needed. An AP team can easily track critical accounts payable metrics for accurate forecasting and opportunities for improvement. When a company uses accounts payable outsourcing solutions, it pays for the services of experienced professionals who don’t need internal training. Every business has unique needs, and your AP service provider should be able to tailor their services accordingly.

Whether you outsource to a third-party provider or purchase AP automation software, the cost savings are there. The choice between outsourcing and automation depends on various factors including the company’s size, internal resources, and long-term financial strategy. Outsourcing is often favored by businesses looking for a hands-off approach and access to external expertise, while automation is preferred by those wishing to maintain control in-house with improved efficiency. The growing popularity of accounts payable outsourcing and accounting outsourcing, in general, can be attributed to a sustained need to make cost savings and compensate for labor shortages.

Automation offers all these outcomes without sacrificing the security or visibility of your AP process. Third-party AP service providers offer professional teams and the latest software to do the job. When you outsource AP tasks to them, you gain access to excellent tools such as computer systems complete with customized invoicing, expense management, and other accounting software. Even after the initial https://www.business-accounting.net/ transition phase, active management and oversight of the outsourcing engagement are crucial. Regular performance reviews and audits should be conducted to evaluate the provider’s adherence to agreed-upon service levels and key performance indicators (KPIs). These KPIs may include metrics such as invoice processing accuracy, on-time payment rates, turnaround times, and cost savings achieved.

In some cases, outsourcing can lead to reduced business control – which is why, picking a reliable outsourcing partner becomes the key. It is important to select a partner that works as an extension to your onshore team rather than serving as a pick and dump. We, at QX, follow a unique partnership approach that allows us to work closely with our clients to devise customized solutions, ensuring that you lose the cost and not the control.

With their meticulous attention to detail and knowledge of industry regulations, they ensure that every payment is accurate and compliant. So, not only do you save money, but you also avoid the comedic disaster of financial mishaps. They understand that accuracy is paramount when it comes to managing accounts payable. That’s why they have implemented rigorous quality control measures to ensure that every invoice is processed with precision. So, while you’re laughing at their lightning-fast operations, rest assured that your financial records are in safe hands. The outsourcing procedure typically begins with a consultation to assess your unique accounts payable requirements.

Businesses can often choose from various service options and features to create a customized AP outsourcing solution that meets their requirements. For five years, I had the pleasure of working with Haroon Jafree at Sabra Hummus. During this time the company was transformed from a small startup to a high-performance company with highly automated processes and systems. Haroon worked on numerous business process reengineering projects with great success achieving significant savings both in the accounting / finance, and operations. As someone who has had a front-row seat to his work, he is very professional in his interactions and is always a phone call away.. Talent with exceptional English proficiency, time zone compatibility, and extensive experience working for a wealth of U.S. clients across industries.

It’s not as if the vendor is a mix of roles from CFO and Controller, to AP Manager and AP Processor, which can happen at smaller firms—one person wearing many hats. Depending on where the vendor is located or if they have a distributed staff, you may find one with near-constant uptime when they are utilizing technology like AP Automation. Additionally, missed or late payments cost your staff time when they have to right the wrong by recovering erroneous spend, which in turn, reduces time available for other AP functions. At CRDF Global, we are committed to promoting diversity, equity, inclusion, and accessibility (DEIA) in all aspects of our operations. Let’s explore how outsourcing accounts payable can lighten your load and boost productivity. Initially, QX collaborates with clients to understand their specific needs and workflows.

Hence, if your business shares duplicate invoices, you are going to have to pay for that too. If outsourcing providers do not have the facility to detect duplicate invoices, then the business ends up incurring more costs than necessary. Many accounts payable outsourcing companies work off-site but use modernized technology that can be tracked at every step.